Workers who contract COVID through exposure to the coronavirus on the job may be able to file a claim for workers’ compensation benefits.

Exposure to the Coronavirus on the job could have a significant impact on a worker and their family. In those rare circumstances where the facts line up to support allowance of a claim, the benefits available under a workers’ compensation claim could help to alleviate this impact.

Coronavirus, COVID-19 and Workers’ Compensation Claims

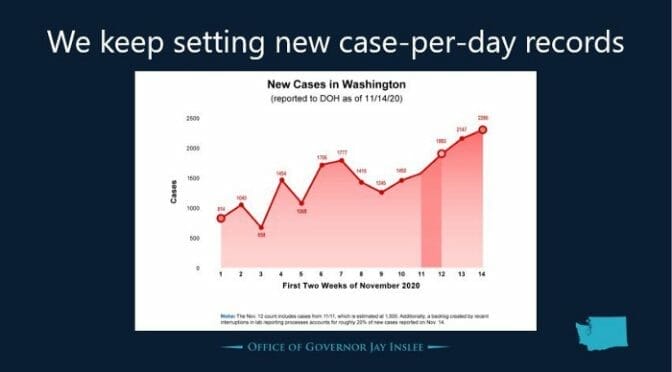

Workers with significant exposures on-the-job, or with specific conditions of their employment exposing them to the virus, could file a claim and potentially receive benefits. With exposure to the Coronavirus rather commonplace within our communities, the connection between work exposure and development of COVID-19 must be direct and clear in order for a claim to be allowed.

Washington State has issued guidance for the Department of Labor and Industries (DLI) that there should be a presumption that the onset of COVID-19 is related to work exposures for some frontline workers, including healthcare workers and medical professionals. If a period of quarantine is medically necessary, the workers’ compensation claim would pay time loss compensation for these workers, even if they are not ill, for up to 14 days.

Other frontline workers, especially those performing essential services in high-risk environments, could also be entitled to benefits under a workers’ compensation claim. For claimants working in jobs not explicitly covered under the presumption of work relatedness, each claim will be reviewed on an individual, case-by-case basis. Specific criteria must be met for a claim to be allowed. The first step is to file a claim.

“Unfortunately, although DLI’s guidance is great news for frontline healthcare workers, for most other people the guidance incorrectly states the legal standard for allowing an occupational disease claim. For instance, DLI suggests that there must be “an increased risk or greater likelihood of contracting the condition” in the person’s particular employment. The Washington State Supreme Court has rejected the “increased risk” test (elsewhere referred to as the “positional risk” doctrine) in several cases, most recently in Street v. Weyerhaeuser, 189 Wn. 2d 187, 200-01 (2018).” –Brian Wright

If you believe you have been exposed to the Coronavirus and developed COVID-19 due to an on-the-job exposure, you should contact an attorney. If you have questions about COVID-19 and workers’ compensation, our firm is available to assist you.

Benefits Under a Workers’ Compensation Claim

The benefits available would include time loss compensation for the days the worker is unable to work due to quarantine or illness. The claim would cover the cost of allowed medical treatment. In many cases, if there is no onset of symptoms or recovery from illness happens quickly, there may be relatively little compensation paid under a claim.

In some cases, people face hospitalization and extended periods of recovery. In King County, as of the date of this writing, the data shows that 6.4% of positive cases require hospitalization. The King County daily summary dashboard provides statistics about testing numbers and rates for positive results, hospitalizations and deaths.

Medical expenses can quickly add up, and time lost from work may be greater than one would expect.

Permanent Impairment After COVID-19

In most cases, there are no lasting effects that remain after recovery from COVID-19. However, it is now becoming clear that there can be permanent effects from COVID-19 in some cases, even for people who recover without the need for hospitalization.

If there is permanent residual impairment after COVID-19, an allowed workers’ compensation claim would provide a monetary impairment award once the claim closes. The most common reported permanent effects are connected to impaired lung function. There are also reports of stroke, kidney, liver and heart conditions that remain after recovery from COVID-19.

Impairment awards paid at claim closure are based on ratings of permanent impairment made by a physician. For injury to internal organs, the State uses a category system for rating impairment. Each category relates to a set of symptoms present, with higher categories compensating for higher levels of impairment due to greater loss of function.

In the rare case where death results, the worker’s family could receive a burial benefit and compensation for the loss of life due to the work exposure and illness.

Filing a Claim for COVID-19

For those that are diagnosed with COVID-19 that were significantly exposed to the Coronavirus on-the-job, a worker can file a claim with the Department of Labor and Industries. A claim can be filed:

- Online via DLI’s FileFast tool.

- By phone: 1-877-561-3453 (FILE).

- At your doctor’s office (if you complete the Report of Accident at your doctor’s office, the doctor files the form for you).

You can watch a DLI video that generally describes the process for filing a claim if you need more information about the steps to be taken.

More Information and Resources

DLI has a page of information and links to resources dedicated to answering questions about COVID-19 and workers’ compensation. This includes questions raised by employers and businesses, injured workers whose non-COVID claims have been impacted by the social changes brought on by the virus, as well as workers who believe they have developed COVID-19 through work exposure.

The Washington Department of Health has a COVID-19 Information Line: 1-800-525-0127. Phone lines are staffed from 6 am – 10 pm. Interpreter services are available in multiple languages.

If you have questions about COVID-19 and workers’ compensation, or if your claim was denied, please feel free to contact our firm. We offer a free case analysis, and would be happy to discuss your specific circumstances with you.

Prior Posts on Related Topics

Like this:

Like Loading...