The Washington State Department of Labor & Industries (DLI) is making a proposal for steady workers’ comp rates for 2021. It is proposing no increase in the average cost for workers’ compensation insurance next year. If the proposal is adopted, this will be the first time in 20 years that workers’ compensation rates have dropped or stayed steady for four years in a row.

“Our 2021 rate proposal recognizes the toll the pandemic is taking on employers and workers in our state,” DLI Director Joel Sacks said. “Although our projected workers’ compensation costs are going up, we’re keeping premiums the same by taking advantage of the reserves we’ve built over the years by improving services and reducing disability.”

Employers and workers pay into the workers’ compensation system to help cover the cost of providing wage and disability benefits for injured workers, as well as medical treatment of injuries and illnesses.

On September 22, DLI began the process of taking public comment on the rate proposal. Hearings will be held in October via Zoom, as well, details below.

Keeping rates steady and predictable

If the proposal for steady workers’ comp rates is adopted, this will be the fourth year in a row with no increase in the average rate.

While financial projections point to the need for a significant increase to cover all of the costs for injuries and illnesses that occur in 2021, the agency is proposing using funds from the workers’ compensations contingency reserve to keep the rate from climbing.

DLI has focused on preparing for a downturn in the economy by building workers’ compensation reserve funds and keeping rates steady and predictable, in part through improvements and reforms. These include implementing vocational recovery services to support return to work for injured workers and employers, and using best practices in occupational health and vocational services.

One effort that’s helped thousands of injured workers and employers is the Stay at Work program. Through the program, employers receive financial support from DLI so they can offer light-duty jobs to injured workers, which allows them to remain in the workforce while they recover.

“We all know how tough it is right now. It’s exactly why we have a reserve— so we are ready for an economic downturn,” said Sacks. “We hope that keeping the average rate the same next year will help our communities get through this and come out the other side strong.”

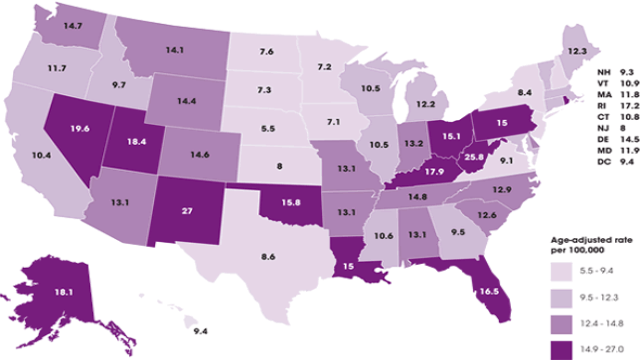

Washington charges for workers compensation coverage based on hours worked. When looking at rates as a percentage of payroll, rates in Washington have gone down each of the last 10 years.

Along with no proposed increase, DLI has been taking steps to help businesses struggling to pay workers’ compensation premiums. In April, the agency announced it was offering a grace period for premium payments, along with payment plans for employers facing financial difficulties during the pandemic. That program was extended in July and has helped thousands of businesses.

Employers and workers would pay the same on average under 2021 proposal

With the proposed overall rate change of zero percent, the average premium per employee is not expected to change overall. However, there will be changes by class and employer.

Workers will pay on average about a quarter of the premium, a similar percentage to that paid in 2020.

Public hearings planned

To support social distancing, public hearings on the rate proposal will be held virtually this year. Two hearings are scheduled to take input about the rate proposal before a final decision is made. Final rates will be adopted by November 30 and go into effect January 1, 2021.

Public hearings are scheduled for 10 a.m. on October 27 and 29. These hearings are being held via ZOOM and by phone to comply with Gov. Jay Inslee’s COVID-19 restrictions limiting the number of people attending in-person public gatherings.

2021 rate hearings

- October 27, 2020 at 10 a.m.

Joining by computer:

Join Zoom Meeting at https://zoom.us/j/99395316830

Meeting ID: 993 9531 6830

Passcode: Oct2720!

Joining by phone: 253-215-8782 US (Tacoma)

Meeting ID: 993 9531 6830

Passcode: 35862365 - October 29, 2020 at 10 a.m.

Joining by computer:

Join Zoom Meeting at https://zoom.us/j/97637403577

Meeting ID: 976 3740 3577

Passcode: 4n*z2LvM

Joining by phone: 253-215-8782 US (Tacoma)

Meeting ID: 976 3740 3577

Passcode: 44645997

People are encouraged to submit comments in writing to:

Jo Anne Attwood

Administrative Regulations Analyst

Department of Labor & Industries

PO Box 41448

Olympia, WA 98504-4148

Or email JoAnne.Attwood@Lni.wa.gov.

All comments must be received by 5 p.m. on October 30.

More information about the proposal is available at www.Lni.wa.gov/2021Rates.